Often, traders combine this with candlestick patterns to signify an entry signal. Using moving averages as a dynamic support or resistance is a common strategy that many traders use.

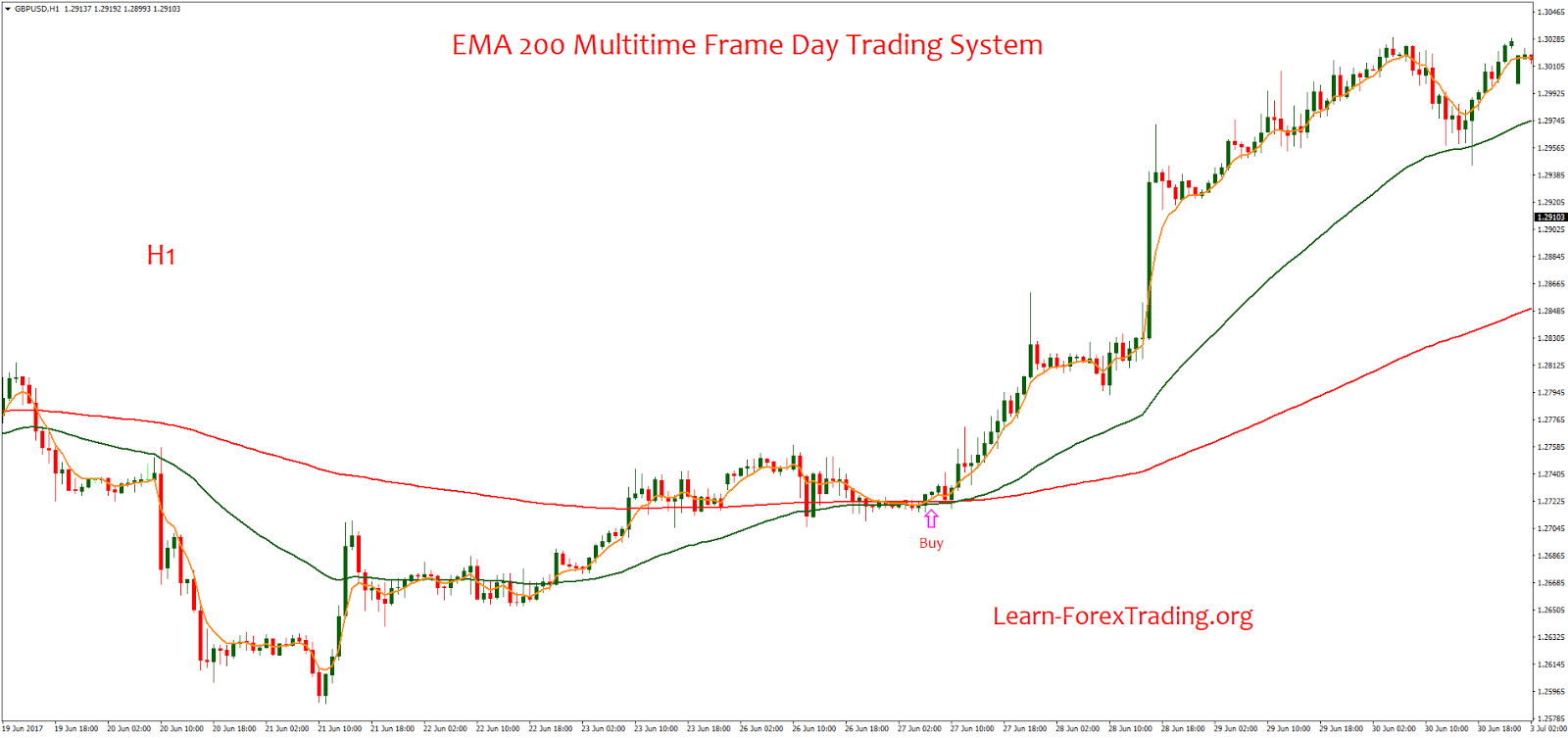

Trading Session: any Buy (Long) Trade Setup Rules Entry

The reverse applies if we are looking for a sell trade. To qualify as a valid buy trade, price and the 50 EMA should be above the 200 EMA. We will also be aligning our entries with the long-term trend direction using the 200 EMA. We will also be using the zigzagarrows indicator as an entry signal, confirming that price is showing signs of bouncing off of a 50 EMA.

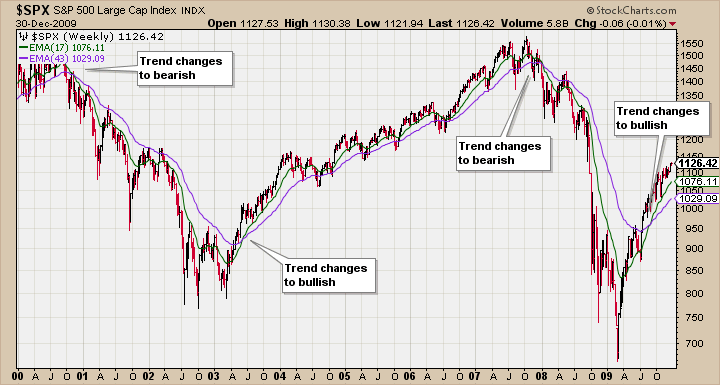

As soon as price touches the 50 EMA, we will be observing if price would show signs of bouncing off it. We will be using the 50 EMA as a dynamic support or resistance. As such, many of the characteristics of a moving average applies to the 50 EMA, such as determining trend direction and acting as a dynamic support and resistance. Longer-term traders use it, short-term traders also use it. It is a moving average which traders often use to determine the intermediate trend. The 50-period Exponential Moving Average (EMA) is one of the most widely used moving average. There will be many instances when as soon as price touches a widely used moving average, price would bounce off it. Because of this, moving averages tend to become dynamic supports and resistances. The inverse applies if prices are going down. If prices are generally going up, seeing price go back to its average would already be a discount. But if you’d think about it, you’d always want to buy at a discount or sell at a slightly higher price. Amazingly, moving averages also do tend to cause price to bounce off it. Caveat though is if the market is still not reversing. Just by identifying where price is in relation to the moving average, we get to answer direction. If price is above the moving average, then the market is said to have bullish bias. It is based on where the current price is or is generally at for the past few candles in relation to the moving average. Moving averages have a very simplistic way of determining trend bias. It is not perfect, but it does work.įirst, the question of direction. This is because moving averages could objectively answer the two questions above, direction and timing. Moving averages are one of the best tools a trader could have.

It is a simple concept but is very useful. Moving averages are simply an average of a trading instrument’s price based on a predetermined number of periods. At what price or when is it going up or down? Moving Averages as a Trend Direction and Entry Point Where is price going? Up or down? That brings your chances to 50-50. But if it were, then every trader should at least be a millionaire by now.Īlthough it is true that buying low and selling high or doing it in reverse is how a trader makes money, there are many things that a trader considers before even attempting to do just that. Its that simple, or is it? I hope it was that simple. In order to successfully trade the forex markets, a trader has to master just two skills, buying at a discount then selling at a higher price and selling at a high price then buying back at a lower price.

0 kommentar(er)

0 kommentar(er)